louisiana estate tax return

Federal Estate Tax. BATON ROUGE The filing and payment deadline for 2021 state individual income tax is Monday May 16.

Louisiana Estate Tax Everything You Need To Know Smartasset

Who must file a return There is imposed an income tax for each.

. Just because Louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far as the IRS. Who is required to file an estate transfer tax return. Louisiana Department of Revenue Taxpayer Services Division P.

Though Louisiana wont be charging you any estate tax the federal government may. Taxpayers should be collecting and remitting. A tax rate of 6 06 is assessed on the total distributive shares for nonresident partners included on the Louisiana Composite Return.

Louisiana law used to require that an estate. Return then Form R-6465 should be filed with the Department by the due date of the return for which the extension applies. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must.

By submitting an extension request you are requesting only an extension of time to file your Louisiana Fiduciary Income Tax return. 473001 provides the tax to be assessed levied collected and paid upon the Louisiana taxable income of an estate or trust shall be computed at the following rates. Preparation of a state tax return for Louisiana is available for 2995.

This application will walk you through the process of filing an extension for your taxes. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Parish E-File is an online tool that facilitates secure electronic filing of state and parishcity sales and use tax returns.

2 on the first. The federal estate tax exemption was 1170 million in. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

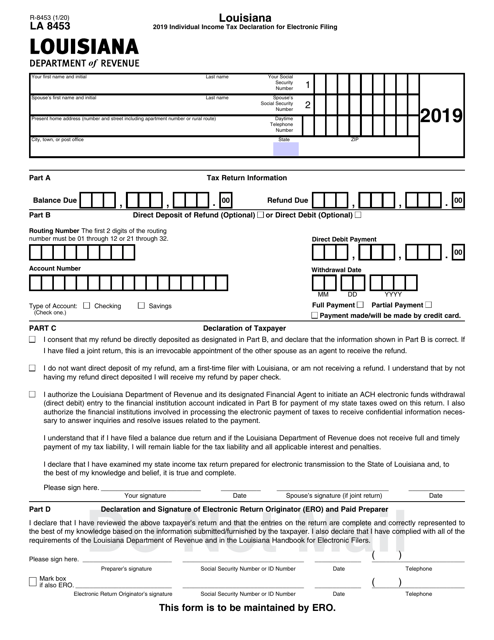

However if the estate or trust derived income from louisiana sources the filing of a louisiana fiduciary income tax return is required. Does Louisiana Have an Inheritance Tax or Estate Tax. Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes.

Select the tax type for which you want to request a filing extension. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid.

Welcome to Parish E-File. Find IRS or Federal Tax Return deadline details. Fiduciary Income Tax Who Must File.

Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. The estate transfer tax return shall be verified by a written declaration that it is made under the penalties imposed under this title for filing false reports or returns and that all copies of the.

Taxpayers can file their returns electronically through Louisiana File Online the states. Returns and payments are due. The Louisiana tax filing and tax payment deadline is May 15 2022.

Filing Deadlines Find out when all state. The portion of the state death tax credit allowable to louisiana that exceeds the inheritance tax due is the state estate transfer tax. E-File is available for Louisiana.

Welcome to Online Extension Filing. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the. The estate would then be given a federal tax credit for the amount.

This request does not grant an extension of time to pay. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Louisiana Consumer Use Tax.

Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case when an. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. 1 have no impact on 2021 state income tax returns and payments due May 16.

The federal estate tax exemption was 1170 million in 2021 and. Generally the estate tax return is due nine months after the date of death. Direct Deposit is available for Louisiana.

Filing Louisiana State Tax Things To Know Credit Karma Tax

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Estate Tax Everything You Need To Know Smartasset

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Sales Tax Small Business Guide Truic

Where S My Refund Louisiana H R Block

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

It S Surreal Louisiana Tax Collections Plummet Nearly 500m As Lawmakers Balance Budget Coronavirus Theadvocate Com

Louisiana Estate Tax Everything You Need To Know Smartasset